Chino Bankruptcy Attorney

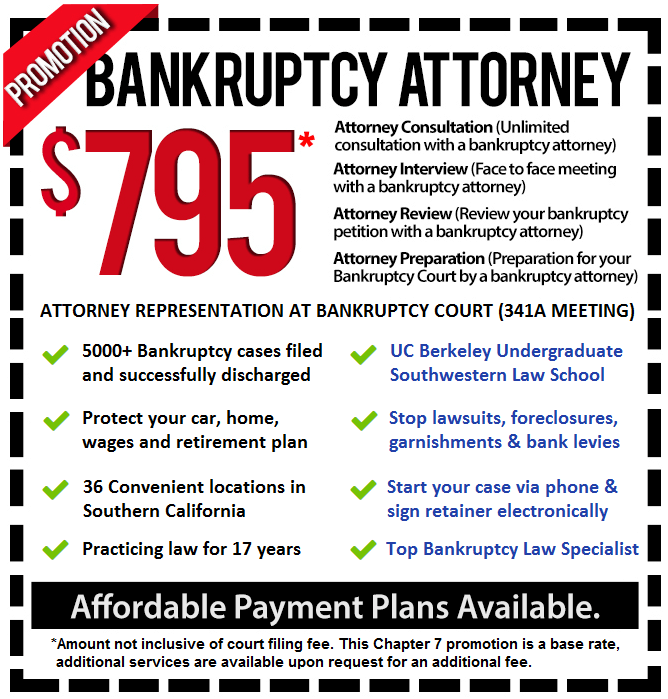

When facing adversity, it is comforting to know that there are services available to help Chino residents like you. Financial stress is a condition that can be extremely harmful especially if you risk losing what you worked so hard to attain. Be reassured that you can discuss your financial situation with a Chino bankruptcy attorney by calling 909-927-8691.

Bankruptcy is no longer a stigma that can prevent you from enjoying life again and achieving success. If you lost a job, overextended your credit cards or had a medical crisis that has you reeling, talk to a Chino bankruptcy lawyer. You need not lose your assets and you can start re-building your credit immediately.

Chapter 7 can wipe out unsecured debt like credit cards and medical expenses. A Chapter 13 can help you get out of foreclosure and catch up with car loan arrearages. Discuss this with a Chino bankruptcy lawyer today before it is too late.

Chapter 11 is typically for corporations and Chino businesses seeking to restructure their operations while paying off creditors and pursuing a new business direction without fear of lawsuits and asset seizures. Have an experienced Chino bankruptcy attorney help you with this complex type of filing.

A Chino bankruptcy attorney can advise you and file any of these types of bankruptcies:

Chapter 7 Bankruptcy

Chapter 7 is a legal way to get rid of unsecured debt without risking the loss of valuable assets. Credit cards, medical expenses and even some tax obligations if your Chapter 7 bankruptcy lawyer deems them eligible can be wiped clean. Debtors do have to pass a means test regarding their income that must not exceed state median amounts that your Chapter 7 bankruptcy lawyer can assess or see if your disposable income is not too high. If you qualify, you take a short debt education class before filing. Another financial management class is taken after you file.

Once your Chapter 7 bankruptcy lawyer files your petition, all collection and legal proceedings must cease. You and your Chapter 7 bankruptcy lawyer will attend a First Meeting of Creditors with the trustee who will ask a short series of questions about your petition. If all goes well, your discharge will be granted in about 4 months. Call the Chino Bankruptcy Attorney today.

Chapter 13 Bankruptcy

If you do not qualify for Chapter 7, have non-exempt assets you wish to retain, face possible home foreclosure or have a business with large debt, then talk to a Chapter 13 bankruptcy attorney. This is a wage earner’s plan that pays back creditors over 3 or 5 years. The qualifications and contents of the petition are similar to a Chapter 13 except that you need a reliable source of income and can make a monthly payment to the trustee to be distributed to your creditors.

If in arrearages on a mortgage or car loan, these can be folded into the repayment plan that your Chapter 13 bankruptcy attorney can prepare. Some secured debt can be revalued to market value and any unpaid secured debt discharged upon completion of the plan. Discuss this with your Chapter 13 bankruptcy attorney.

Chapter 13 has debt limits on secured and unsecured debt. If you surpass these limits, your Chapter 13 can work to see if he or she can get them below the limits. Call the Chino Bankruptcy Attorney now for a free consultation.

Chapter 11 Bankruptcy

Chapter 11 is a reorganization process for corporations and large businesses as well as for individuals who do not qualify for Chapter 7 or 13. It is vital that a Chino bankruptcy lawyer handle a Chapter 11 since it is complex and involves many formalities and filing requirements.

Small businesses can fast-track the process and bypass many of the requirements and proceed at a less costly and faster rate. Check with a Chapter 11 bankruptcy attorney on how your small business might benefit.

After filing, a Chapter 11 bankruptcy attorney will draft and submit for approval by the largest creditors a plan for restructuring and for returning the business to profitability. In large cases, several committees might be formed that can submit competing plans. Once a plan is approved, a trustee oversees the operations. The debtor business leaders can renegotiate contracts and leases and offer payment to creditors at rates below what is owed.

Bankruptcy can relieve Chino debtors and businesses from burdensome debt and get you back to a path of success. Call a Chino bankruptcy lawyer at (888) 754-9877 and discuss how bankruptcy can be a solution.